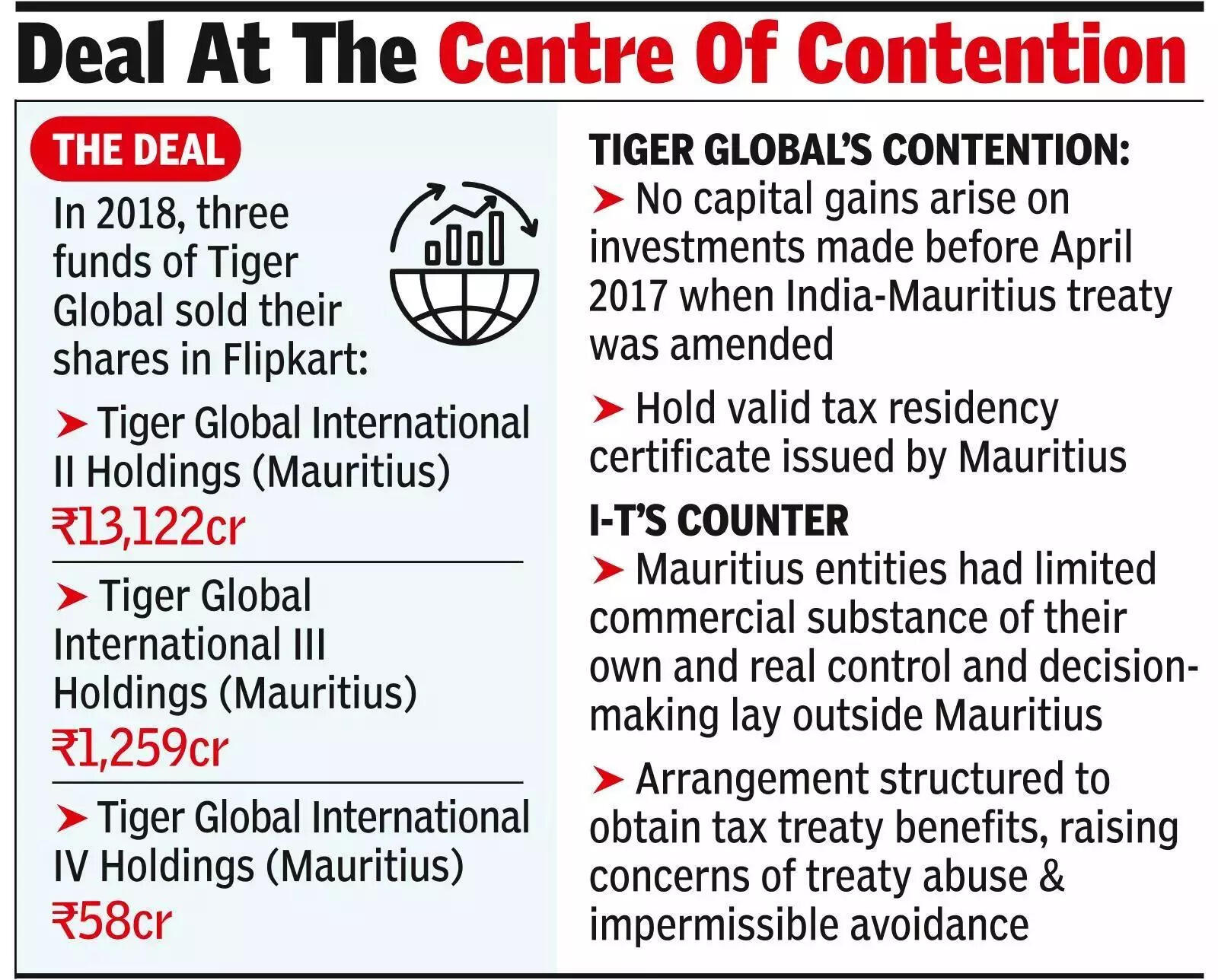

NEW DELHI: Armed with the SC order, the income tax department will revive Tiger Global’s assessment for 2018-19 and deal with its refund claim of Rs 968 crore, even as investors review their transactions with some in the pipeline expected to be delayed.On Thursday, SC had upheld the I-T department’s claim related to Tiger Global’s stake sale in Flipkart in 2018 for a consideration of Rs 14,500 crore. The order is seen to have upset the tax planning undertaken by investors.“Investors are worried about not just transactions that are being negotiated, but about earlier ones as well and what happens to them now,” said a leading tax expert. Officials, however, said that the ruling will not result in the department going after more players, who had taken a similar route to invest in India. But, tax experts and investors are worried about the implications of what they call repeated interpretations. But, officials argue that these disputes arise due to differences in interpretation of the law in evolving fields.“The recurring judicial scrutiny of the India-Mauritius DTAA, culminating in the Tiger Global judgment, underscores how a regime once regarded as settled has been reopened with far-reaching consequences. For decades, foreign investors structured their India exposure on the basis of explicit govt policy, binding circulars and consistent judicial affirmation that a valid tax residency certificate conferred treaty protection. While the sovereign right to tax is unquestionable, revisiting and effectively neutralising a conscious policy choice retrospectively risks unsettling long-standing expectations,” said Dinesh Kanabar, chairman & CEO, Dhruva Advisor.

Another tax practitioner said courts have undertaken repeated reviews and the issue is “resettled every few years”, pointing to past cases, including Vodafone’s dispute with I-T department.“The judgment goes beyond legal interpretation and enters the realm of tax policy, prescribing how treaties should be negotiated and how abuse should be addressed, traditionally the domain of the executive. This blurring of institutional boundaries introduces uncertainty into an area where predictability is paramount,” said Kanabar.“This ruling is bound to cause a dent to the confidence of foreign investors in the certainty of Indian tax policy. Challenging and reversing years of jurisprudence and tax policy is a wrong message going to foreign investors,” added Amit Maheshwari, managing partner at AKM Global, a tax and consulting firm.