If I had a rupee for every time someone told me “Sir, I am a moderate-risk investor,” I could start my own small-cap fund.“Moderate risk” is the NSE of personal finance: everyone mentions it, few can define it, and almost nobody behaves according to it.On good days, when markets are going up, your risk appetite looks like Salman Khan on a bike. Small-caps, options, IPOs, crypto—sab chalega. On bad days, when markets are falling, the same person suddenly wants only FDs, gold and a guarantee from the RBI governor in writing.So let’s start with a simple truth: your “risk profile” is not carved in stone. It changes with the market, your age, your job, your experiences, and, most importantly, your mood.At Value Research, we try to separate three different things that people mix up when they say “risk”:

- Risk capacity – how much risk your finances can handle.

- Risk need – how much risk you must take to reach your goals.

- Risk tolerance – how much risk your brain and heart can live with without doing something foolish.

The right level of risk is somewhere between these three, not what you feel on a good market day.Let’s put some perspective to this.Think of a 30-year-old with a stable job, no dependents and a 25-year retirement horizon. On paper, their ‘risk capacity’ is high: plenty of time, no big obligations yet. But if this person panics and wants to redeem whenever the price falls by 10 per cent, their ‘risk tolerance’ is low. Now add the third piece: if they want to retire at 50 with a large corpus, their ‘risk need’ is high—they probably can’t get there with just FDs.This is the real puzzle. You can’t just say “I don’t like risk” if your goals and income require some equity exposure. You also can’t just say “I like risk” if you have a single income, EMI, two kids and no emergency fund. The numbers and the behaviour both have to be in the room.Now, why does your risk appetite keep changing? Because you are human. In bull markets, recent returns are high, and everyone you know is bragging. You feel fearless and underinvested. In bear markets, the same portfolio suddenly looks dangerous and oversized. The external environment hasn’t changed you, but it has changed how you feel about the same risk.

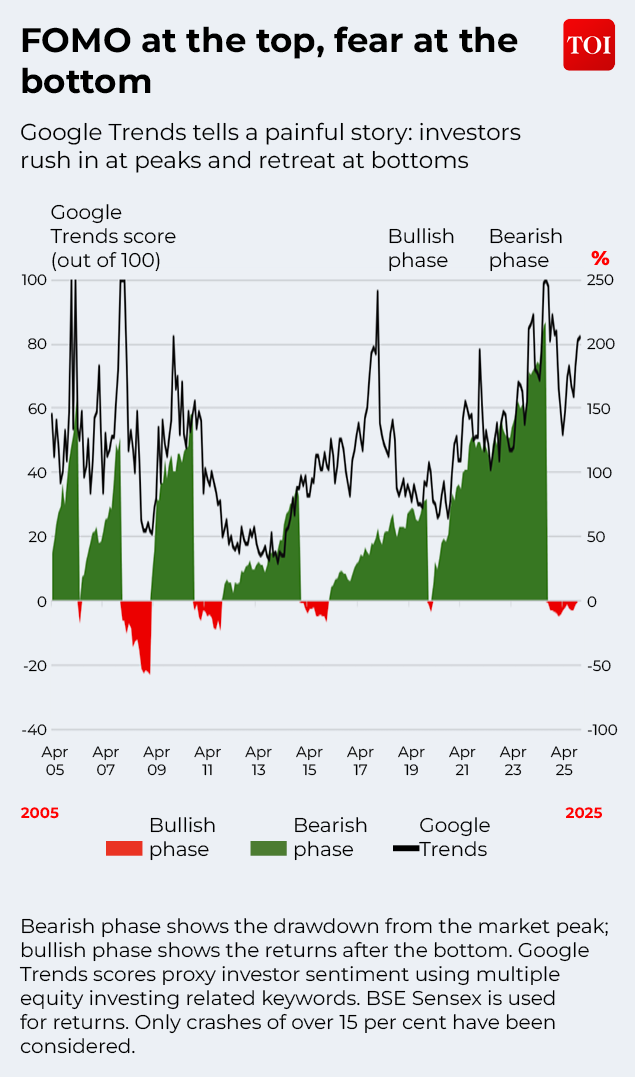

FOMO at the top

At Value Research, our analysis of investor behaviour shows the same pattern: search interest in equity markets rises after euphoric returns and falls during market corrections. Emotionally understandable. Financially backward.So how do you pin down a level of risk that’s right for you, without letting your mood of the month decide?A practical approach is to start from your goals and timeframes, not from products. Suppose you’re saving for three buckets:

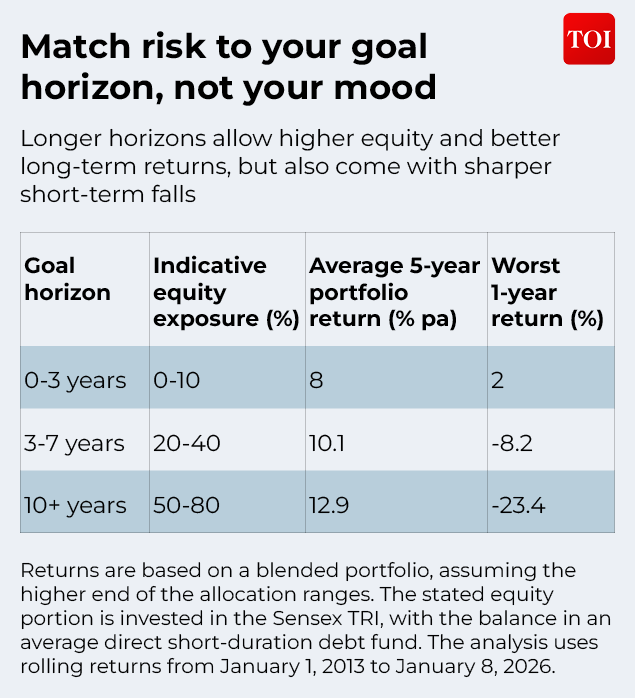

- Emergency and near-term needs (0–3 years)

- Medium-term (3–7 years) – say, a car upgrade or a child’s school fees

- Long-term (10+ years) – retirement, child’s college

Match risk to goal

This is not a prescription; it’s a way to think. Once you fit your money into these buckets, your “risk appetite” for each bucket becomes clearer.The next step is to stress-test your feelings. Ask yourself: if my equity portion fell 20–30 per cent on paper and stayed there for a year, would I:

- Lose sleep but manage to hold on,

- Silently continue my SIPs and curse me later, or

- Immediately redeem everything and promise “never again”?

Your honest answer defines your risk tolerance a lot better than any form that asks, “On a scale of 1–5, how adventurous are you?”At Value Research, we try to reflect this in the equity–debt split we suggest. If the numbers say you can and should take more risk, but your behaviour clearly can’t handle it, we don’t push you into an 80% equity portfolio just because a formula said so. A 60% equity allocation you can live with for 20 years is far better than a 90% equity allocation you abandon in three.One more thing: your risk level should change with your life, not with the market. When you’re young, single and just starting out, you can survive more volatility because you have time to recover and future income ahead. As you approach a goal—say, your child’s college in three years—you should gradually reduce equity, even if markets are booming. The goal doesn’t care about your bravery; it cares about whether the money is there when needed.So, how much risk is right for you? The honest answer is: the amount that your goals need, your financial situation can handle, and your nerves can tolerate through at least one ugly cycle.The reason your appetite for risk keeps changing is that you’re letting the market decide it for you.If you want one simple takeaway, here it is: decide your risk level on a calm day based on your life, not on the market. Write it down, turn it into an asset allocation (how much in equity, how much in debt), and then let that guide your choices. Don’t increase equity just because the index hit a new high, and don’t dump equity just because the index hit a new low.Markets will always be moody. You don’t have to be.(Dhirendra Kumar is Founder and CEO of Value Research)If you have any queries for Dhirendra Kumar you can drop us an email at: toi.business@timesinternet.in(Disclaimer: Recommendations and views on the stock market, other asset classes or personal finance management tips given by experts are their own. These opinions do not represent the views of The Times of India)