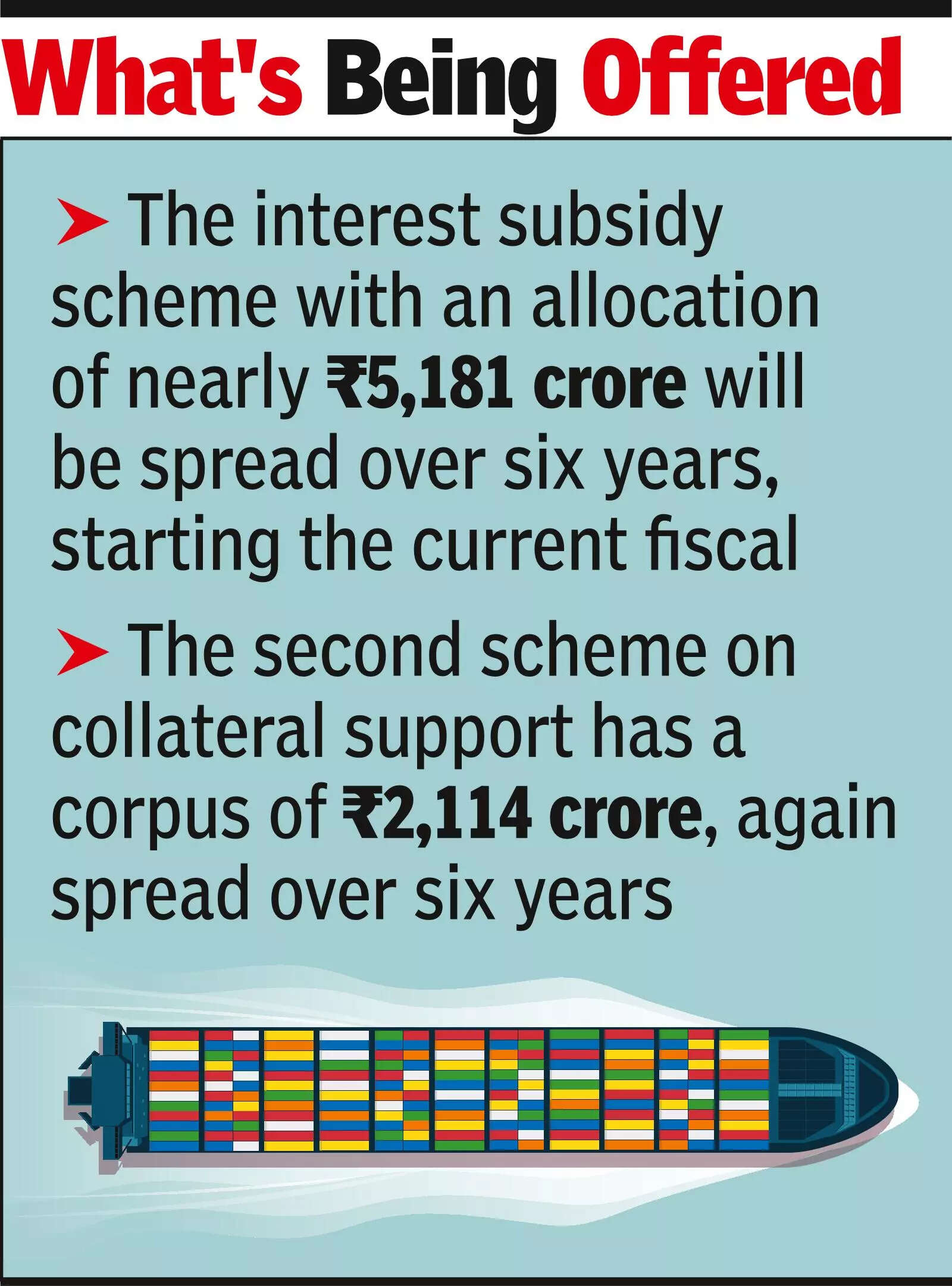

NEW DELHI: The commerce department on Friday unveiled a new interest subsidy mechanism targeted at MSMEs, along with a corpus to guarantee loans to small businesses that export. The interest subsidy scheme, which has an allocation of nearly Rs 5,181 crore spread over six years starting the current fiscal, will offer a 2.75% subsidy on loans with a reset planned every six months. The extent of subsidy will be linked to the repo rate as well as interest rates in other competing economies, a senior official told reporters, adding that the move is meant to address a critical handicap faced by small businesses.

What’s being offered

Besides, an incentive will be offered to exporters selling goods in new and emerging markets, with the details of the scheme to be announced in the coming weeks along with initiatives to develop other financial tools such as factoring. For years, Indian businesses have complained of lack of access to credit and higher interest rates as major impediments. Officials said that currently, small businesses borrow at 9-12% to meet their export credit requirement and the subsidy will provide some relief. Wiser by its earlier experience, this time, the Directorate General of Foreign Trade has capped the annual interest subsidy assistance at Rs 50 lakh per businesses with 75% of the product lines, especially the labour-intensive ones, eligible. The second scheme on collateral support has a corpus of Rs 2,114 crore, again spread over six years, with govt hoping to leverage it 30-35 times in helping facilitate the flow of loans of Rs 60,000-65,000 crore. “The amount of delinquency is 3-4% and it seems to have peaked, so money can be leveraged to provide more loans,” said an official. For micro and small businesses, guarantee cover of up to 85% will be provided, while it will be capped at 65% for medium enterprises. “The launch of interest support for pre- and post-shipment export credit and the collateral guarantee mechanism marks a decisive step towards addressing two of the biggest challenges faced by MSME exporters- high cost of credit and lack of collateral,” said Fieo president SC Ralhan.