At 9:01am this Monday, something quietly historic happened on the National Stock Exchange. For the first time, options-crazed traders didn’t dive straight into live futures prices at the opening bell – they had to watch a call auction screen instead.NSE’s new 15-minute pre-open session for equity derivatives went live on December 8, in what traders are already calling the biggest structural change in the F&O segment since weekly options took over the market.This move by the NSE is not just a tweak in market timings but a strategic effort to restore stability, transparency, and fairness in what has become one of the most hyperactive derivatives markets in the world.With nearly 60% of global equity derivatives contracts now traded in India, mostly by retail participants who often lack risk management knowledge, regulators have been concerned about rising losses and volatility.

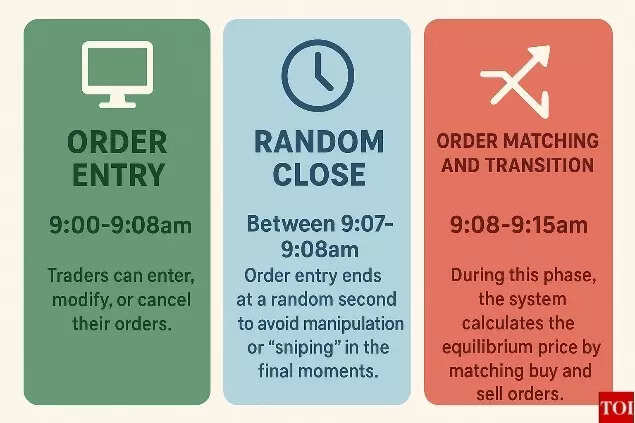

The pre-open is part of a broader campaign to bring order to this chaos. But will it work? Here’s an explainer that breaks it all down.What is the new pre-open session for F&O all about?NSE has rolled out a 15-minute pre-open session specifically for equity derivatives. This includes index futures and single-stock futures. As explained in NSE circulars, “the F&O pre-open runs every trading day from 9.00am to 9.15am.” This mirrors the existing pre-open for the cash equity segment but is a first for derivatives.During this session, traders can place, modify, or cancel their orders in a structured format before actual trading begins. According to the NSE, the main goal is to ensure a fair and efficient price discovery mechanism before the market transitions into the high-speed continuous trading phase.How exactly does the new pre-open auction work?The session is divided into three distinct phases:

- 9:00-9:08am (Order Entry): Traders can enter, modify, or cancel their orders.

Random Close (Between 9:07-9:08am): Order entry ends at a random second to avoid manipulation or “sniping” in the final moments.- 9:08-9:15am (Order Matching and Transition): During this phase, the system calculates the equilibrium price by matching buy and sell orders.

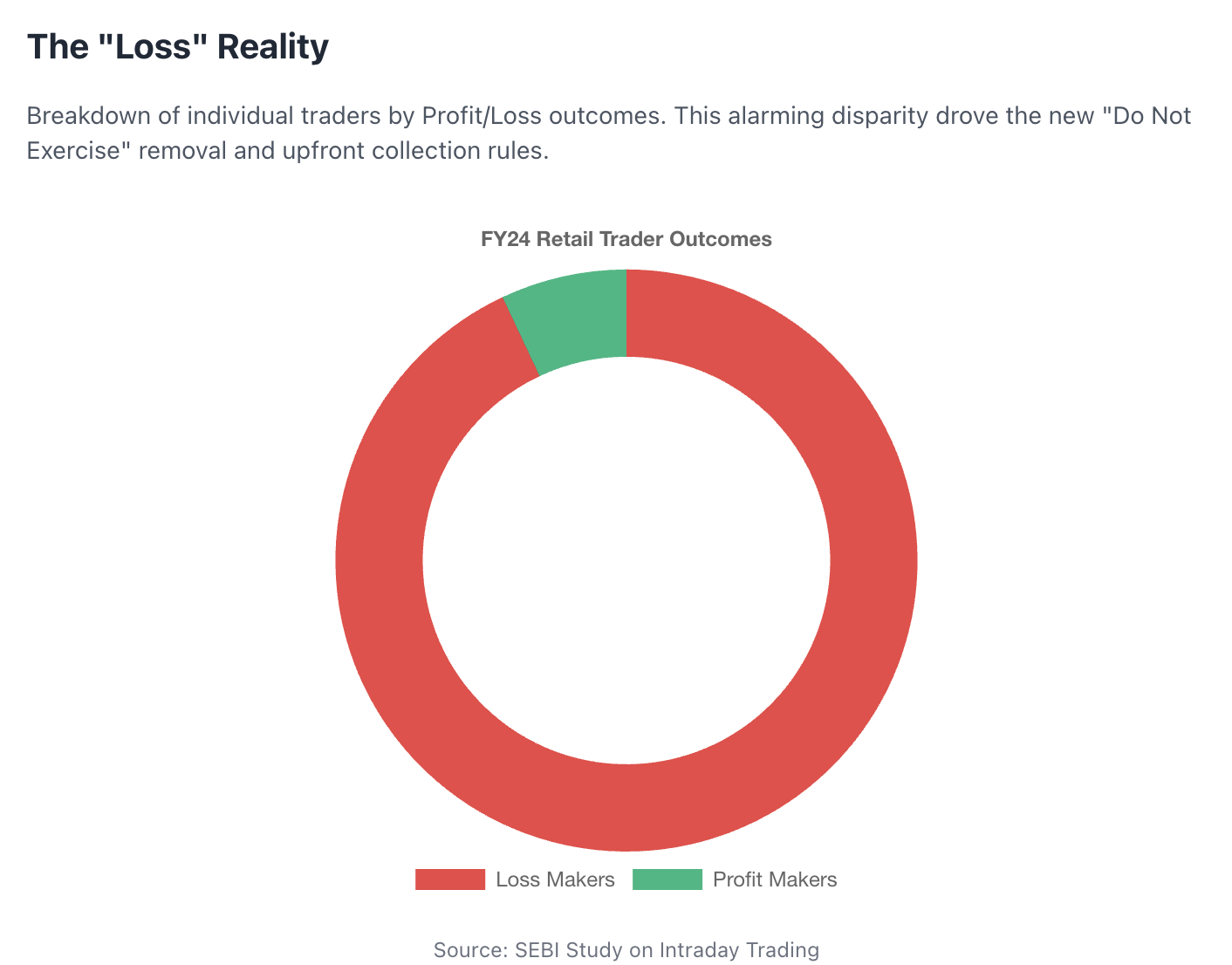

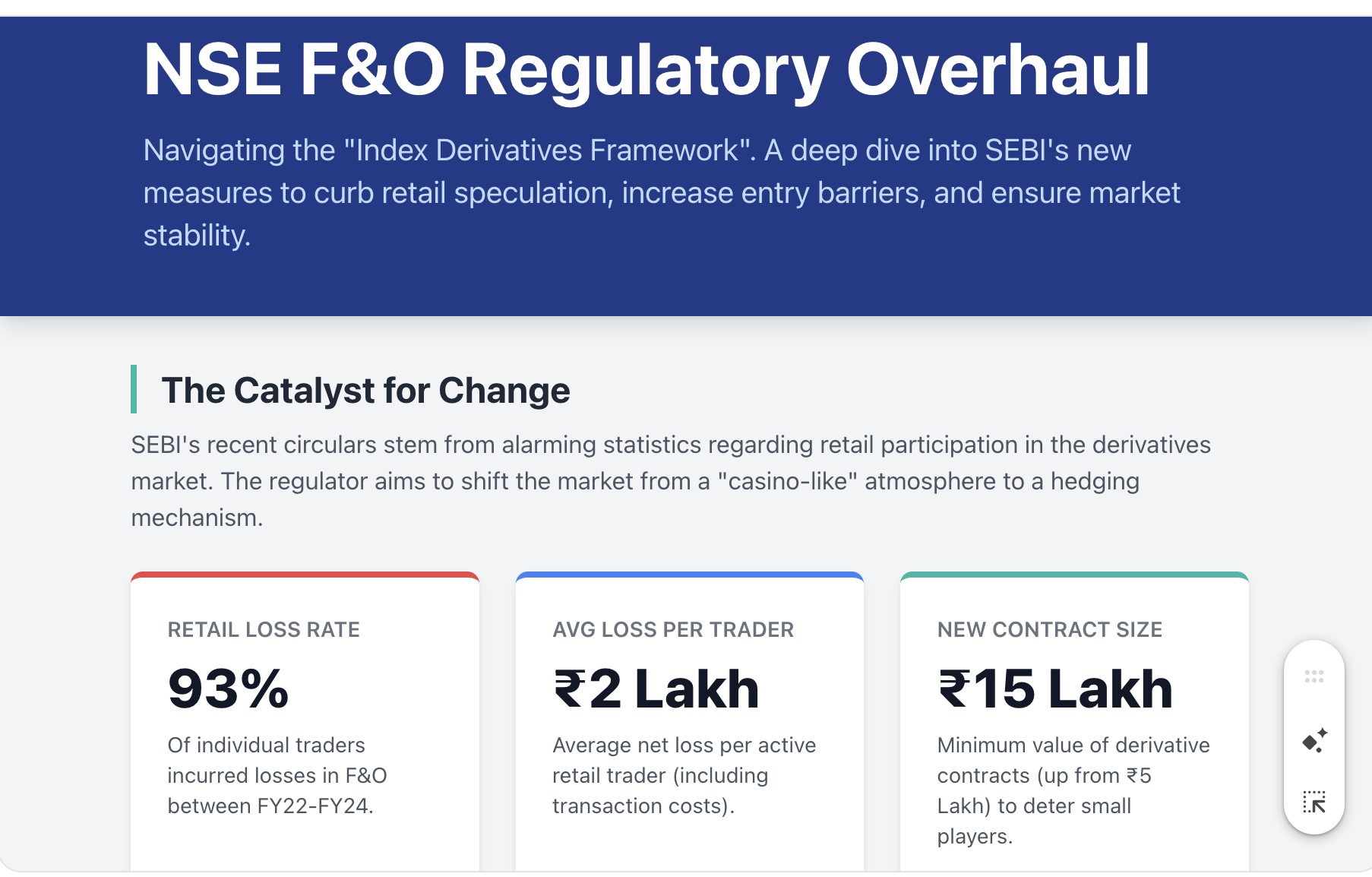

As per NSE India’s product note, “the system continuously shows an indicative match price and quantity based on all buy and sell orders.” At the close, it determines a single opening price that maximizes the volume of trades while minimizing order imbalance—a standard feature of call-auction mechanisms globally.What types of contracts are covered?Initially, the pre-open applies to current-month index and single-stock futures. However, in the final five sessions before expiry, next-month futures are also included. This ensures smoother rollovers and reduces volatility during contract expiry periods. (Source: Business Today)Why did Sebi and NSE feel this change was necessary?The primary motivation behind this structural shift stems from growing concerns about the explosive growth in F&O trading—especially in ultra-short-dated options—by retail traders. As reported by Reuters, Sebi has been trying to curb what it called a “derivatives frenzy.” The statistics tell a troubling story:

- In FY25, 91% of individual traders in the equity derivatives segment lost money, with net losses hitting Rs 1.05 lakh crore, a 41% increase over the previous year.

- Over FY22 to FY24, retail traders collectively lost over Rs 1.8 lakh crore in F&O trading.

- India now contributes nearly 60% of global equity derivatives contracts, with much of this activity driven by weekly index options.

To counter this trend, Sebi introduced several reforms, including:

- Limiting the number of weekly expiries;

- Standardizing expiry days to Tuesdays (NSE contracts) and Thursdays (BSE contracts);

- Increasing contract sizes and tightening eligibility criteria;

- Investigating manipulation, leading to a high-profile ban on Jane Street and penalties for “unlawful gains.”

The pre-open auction is seen as a continuation of these reforms, aiming to reduce volatility and improve market safety at the start of each trading day.What are the expected benefits of this pre-open session?The auction-style format is expected to deliver several advantages:

- Stabilising opening prices: “Reduce wild price swings at the open.”

- Preventing freak trades: Helps catch mis-typed or poorly placed orders before they impact live markets.

- Level playing field: Everyone sees the same indicative prices, reducing the edge of ultra-fast algos in the opening seconds.

The NSE believes this “standard call-auction mechanism” will give all participants—retail traders, institutions, and algos—a better sense of where the market wants to open, leading to more orderly price formation.

How have traders and brokers reacted to the new system?Institutional traders and high-frequency trading (HFT) desks had advance notice and participated in mock sessions conducted in October and December. As per NSE India, brokers were advised to update to a new NEAT+ version to simulate pre-open behavior.For large traders, this change is a systems update: tweak algorithms, recalibrate models, and adapt risk strategies. For smaller players, however, the impact is more behavioral.One discount broker put it this way: “The real price discovery zone is now 9:00-9:15.” Their advisory to clients is clear—watch the indicative auction price rather than rushing into trades at 9:15.Retail traders who usually enter market orders without checking depth may benefit from the price stability. On the flip side, some worry that this could become another speculative game, with influencers possibly encouraging bluff orders or “hacks” to manipulate the indicative price.Can this change really make markets safer for retail participants?While the pre-open helps reduce chaos at the open, it’s not a silver bullet.Pre-open auctions:

- “Reduce opening volatility and outlier trades;”

- “Improve fairness by ensuring all orders interact in a single pool;”

- “Provide clearer signals of where the market wants to trade.”

But they don’t:

- “Prevent people from over-leveraging on weekly options;”

- “Stop algorithmic players from gaming the auction itself;”

- “Guarantee that small traders suddenly start making money.”

The root problem is behavioral. Most retail traders lose money due to poor risk management, excessive leverage, and lack of understanding. Structural reforms like pre-open auctions can only do so much without accompanying financial literacy and stricter investor suitability checks.What’s the broader significance of this move?Beyond the technicalities, the F&O pre-open represents a directional shift in how Indian markets are being shaped. As Reuters puts it, this is part of a “slow pivot away from ‘everything for volume’ towards a more sustainability-focused model.”For brokers whose revenues depend on high-volume index options trading, this could be a turning point—forcing them to move towards more stable offerings like advisory, mutual funds, and global investing.For the regulator, it’s about balance—maintaining India’s lead in global derivatives trading while preventing the ecosystem from turning into a funnel that “systematically transfers wealth from retail punters to a tiny sliver of sophisticated traders.”For the average retail trader logging in at 9:05am, this is a moment to pause—literally. Instead of being thrown into a frenetic live market, they now see a screen where prices are being discovered in real-time through collective input. Whether they use this pause for reflection or speculation is the next big question.So, what comes next?The early days of the F&O pre-open will be closely watched by all stakeholders—traders, brokers, regulators, and market infrastructure providers. Will it reduce volatility? Will it prevent disasters caused by freak trades? Or will it simply become another microstructure exploited by savvy players?Its success will ultimately hinge on behavior. If it leads to better-informed trading, fewer knee-jerk decisions, and a reduction in trading losses, the experiment may well justify its place in the market’s daily rhythm.But without broader reforms—better education, tighter controls, and more responsible intermediaries—this 15-minute tweak, though historic, may only scratch the surface of India’s derivatives addiction.(With inputs from agencies)