Natalie ShermanBusiness reporter

Warner Brothers Discovery

Warner Brothers DiscoveryParamount Skydance has made another offer to buy Warner Bros Discovery as it seeks to trump a rival plan from Netflix to buy the company’s studio and streaming networks.

Paramount, which is backed by the billionaire Ellison family, said it was making a direct offer to shareholders of $30 (£22.50) per share to scoop up the whole of Warner Bros, including its traditional television networks.

It said its proposal was a “superior alternative” to Netflix’s, delivering more cash upfront to shareholders and greater prospect of approval by regulators.

President Donald Trump has said “there could be a problem” with Netflix’s purchase, pointing to competition concerns given the size of the companies.

Paramount is a smaller player than Netflix that is known for brands such as CBS News, Nickelodeon and Mission Impossible.

It started submitting offers a few months ago, eventually prompting Warner Bros, owner of HBO and classics from Looney Tunes to Harry Potter, to formally open a bidding process.

Wall Street analysts have long said they believe a Paramount-Warner Bros combination makes sense, because it would give the company the scale to compete against rivals such as Netflix and Disney.

Paramount was also seen as a strong suitor because the relationship between Trump and the Ellison family, including tech billionaire and Republican megadonor Larry Ellison, was expected to help ease the approval process.

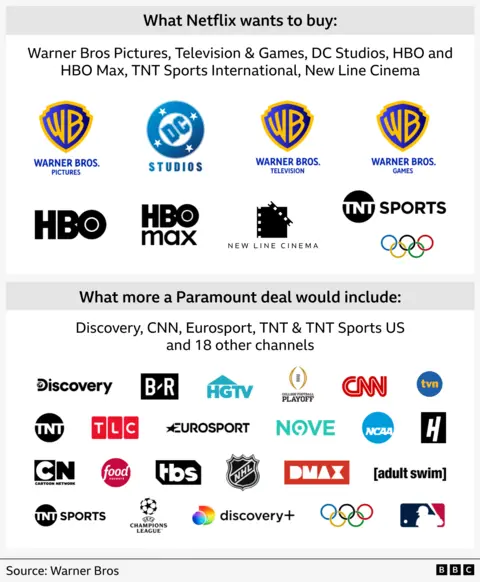

But Warner Bros declared Netflix the winner of the auction on Friday, announcing a deal that valued its studio and streaming networks, including HBO, at about $83bn (£62.3bn), including its debt.

It said the sale would proceed after a planned spin-off of other parts of Warner Brothers’ business, including CNN, into an independent company.

Paramount’s offer values the entire company at $108.4bn, which it said was a better deal. Trump’s son-in-law, Jared Kushner, is among the financial partners Paramount is working with as part of the deal, according to paperwork submitted to the Securities and Exchange Commission.

Netflix executives on Monday expressed confidence in their plans, dismissing Paramount’s attempt as “entirely expected”.

Either takeover is expected to face scrutiny from competition regulators in the US and Europe.

Analysts said Netflix’s plan would likely raise concerns about dominance in streaming, while Paramount’s proposal would prompt a review of the impact on advertisers and local television distributors, given the power of a combined company over sports and children’s networks.

Paramount’s plans, which would put CBS and CNN under the same parent company, have also been closely watched because of the potential impact on the news business and the Ellisons’ ties to Trump.

The president said over the weekend he expected to be involved in the approval process.

But he has offered little certainty about his views.

While noting potential concerns about Netflix’s tie-up on Sunday, he also praised the streamer’s bosses. Meanwhile on social media on Monday, he took aim at Paramount for a 60 Minutes interview that it aired with former Trump ally Marjorie Taylor Greene, a Republican representative.

In an interview with CNBC, Paramount chief executive David Ellison said he had had “great conversations” with Trump about the deal, while noting that he did not want to speak for the president.

Netflix is the biggest streaming company in the world, with more than 300 million subscribers.

Mr Ellison’s plan would build on his purchase earlier this year of Paramount, which he folded into his Skydance film studio.

“Paramount ultimately needs this deal more than Netflix,” said Ben Barringer, head of technology research at Quilter Cheviot, calling the Warner Bros assets simply “nice to have” for the streamer.

Speaking to CNBC on Monday, Mr Ellison talked up the benefits of his plan for the entire media industry, arguing that Netflix’s takeover of Warner Brothers Discovery would give one firm too much power over actors and other players in the industry.

“It’s a horrible deal for Hollywood,” he said.

He also said he thought Warner Bros’ plan to spin-off its traditional networks into an independent company would set them up to fail and ultimately prove a mistake for shareholders.

“I think [its shares are] going to be worth a lot less than people are claiming,” he said.

But Netflix executives, who spoke at a business conference on Monday, said they were confident their takeover could win approval, noting that their plan does not include plans for major cuts.

Shares in Warner Bros were up more than 3% in midday trade on Monday, while Paramount shares were also up.

Shares in Netflix, however, dropped.